The Top 7 Factors Affecting Your Car Insurance Price

Insurance Price

Insuring your car is an expense you can’t avoid – but it’s more costly for some than others. Goodbye Car investigated the top 7 factors that affect the price of your car insurance* (for better or worse) and uncovered some surprising stats you may not have considered.

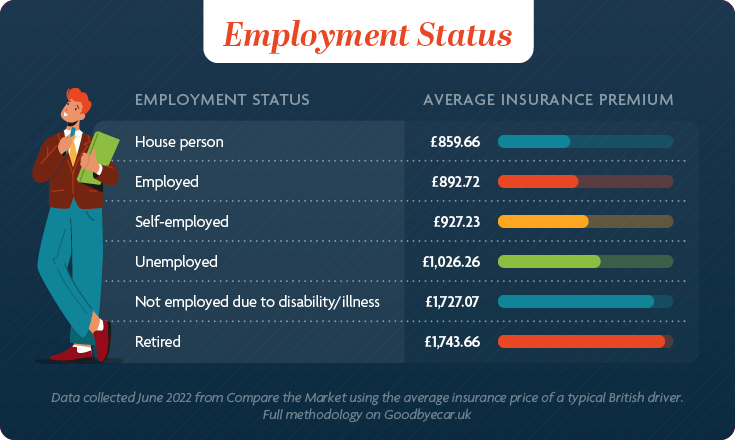

1. Employment Status – Disabled and retired drivers pay almost double that of those in employment

While risk is surely a factor that goes into setting insurance prices, it’s disappointing to find that arguably the most vulnerable in society are charged more for their car insurance. A person of retirement age can expect to pay almost double that of a homemaker, while those who are not employed due to a disability or illness will pay over £830 more for their car insurance.

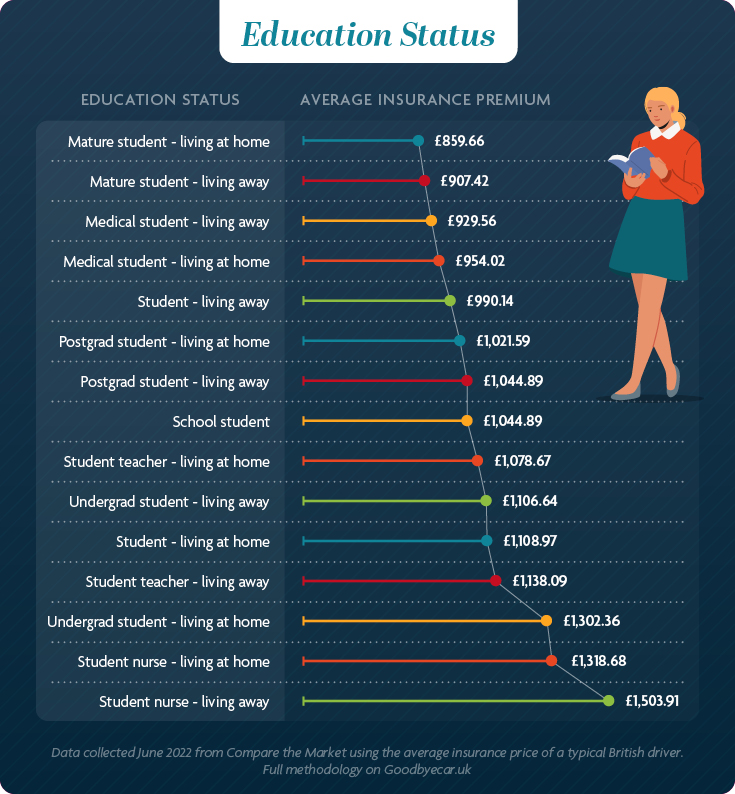

2. Education – Student nurses are charged the most for car insurance

It isn’t a surprise to learn that nearly all students have a higher insurance price than those in employment. But what is unusual is that many of the students that you would typically consider to be more responsible are charged higher prices. For example, a student nurse living away from home can expect to pay almost £400 more than an undergraduate student living in uni accommodation. Similarly, an undergraduate student living at home will be charged just over £250 more than a school student.

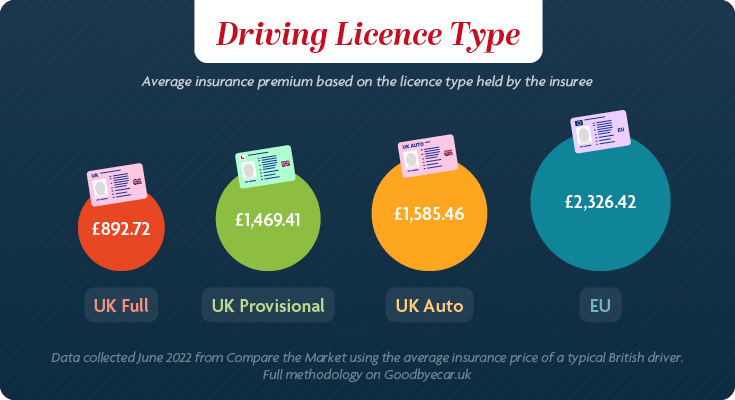

3. Driving licence Type – EU licence holders charged over £1,400 more for car insurance

It stands to reason that a full UK licence will result in cheaper car insurance in the UK compared to an EU licence – but the price gap is significant, with EU licence holders being charged over £1,400 more than UK full licence holders. Again it stands to reason that car insurance for those with a UK provisional licence is more expensive than those with a full licence, but it’s surprising to find that UK automatic licence holders are expected to pay almost £700 more. With the change to electric vehicles that are all automatic, this discrepancy in price appears outdated.

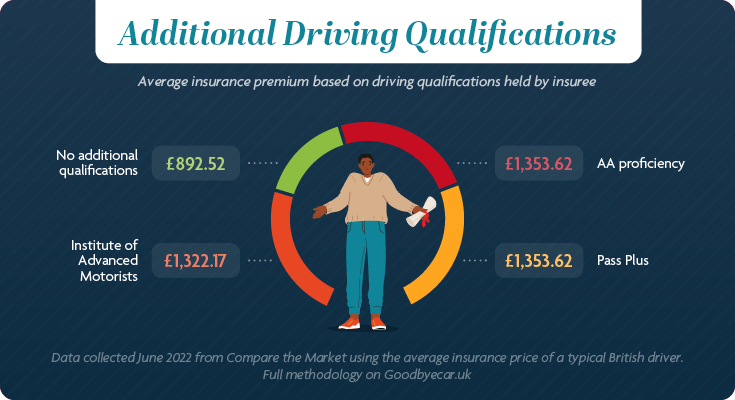

4. Additional driving qualifications can increase your car insurance quote by over £450

Those that undertake additional driving qualifications may be honing their skills on the road, but instead of being rewarded for their extra knowledge, they can expect to pay over £450 more than a driver holding a standard UK licence.

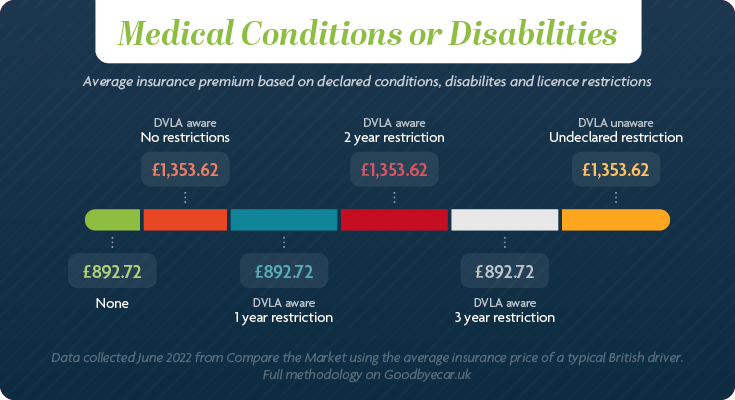

5. Medical conditions or disabilities can increase car insurance by up to £865

Reportable medical conditions or disabilities can increase the cost of your car insurance If the DVLA is aware of your medical condition or disability, you’ll be expected to pay an additional £460. If the DVLA hasn’t been made aware, the cost rises by another £405. However, there’s a surprisingly small difference between those with a restricted licence and those that haven’t made the DVLA aware. If the DVLA is aware and has restricted your licence, you only save £25 compared to if you’d never declared your condition or disability at all.

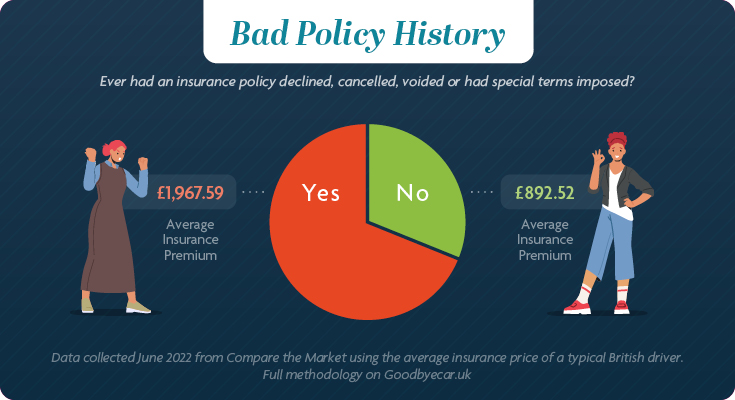

6. A bad insurance policy history can cost you over £1,000

If you have ever had an insurance policy declined, cancelled, voided or had special terms imposed, it could cost you over £1,000 to insure your car. A spotty history with car insurance tips the insurance company off that you may be an unreliable customer, and they impose a large penalty for this risk.

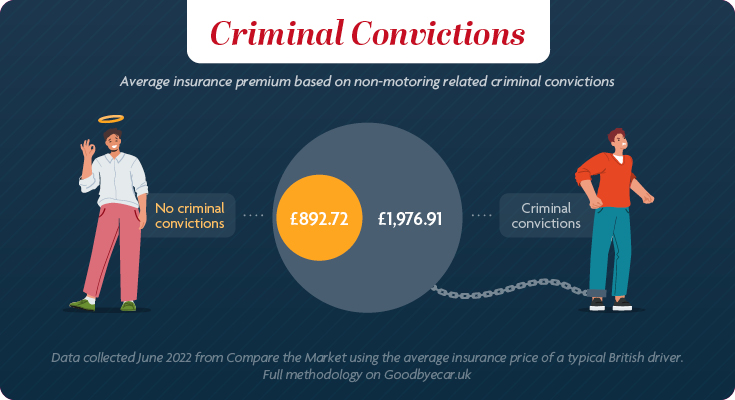

7. Criminal convictions can add £1,000 to your car insurance

While it’s expected that motoring criminal convictions would result in a much higher cost for car insurance, unspent non-motoring-related criminal convictions will also push prices up. The penalty for any criminal conviction is a rise of over £1,000 to insure your car.

*Prices accurate as of 01.06.2022 from Compare The Market Car Insurance

Methodology

We looked at the average insurance price of a typical British driver and compared quotes using Compare the Market. The driver’s profile was created using sources including the Office for National Statistics and NimbleFins.

Our research shows the typical person drives a new Vauxhall Corsa, has an annual mileage of 6,800 miles and opted for comprehensive insurance. The driver is 39 years old, married, works as a manager in retail, has been driving for 20 years and has a clean licence.

Then, we changed one factor to show the difference compared to the original insurance quote (£892.70). Overall, we compared 38 different factors to the original insurance quote to find the top variables which resulted in the highest increases. Data collected in June 2022.